Maximize Your Earnings: Unlock Tax-Free Working Capital Buried in Your Balance Sheet Developing Your Customized Equity Growth Compound Account!

Discover The Equity Banking Strategies That Positions 8 Crucial Numbers In A Unique Cash-Flow Pattern That Grows Your Income By Multiplying The Use of Every Dollar Earned!

Our 5-Day Mini Course Helps You Develop Your Own Equity Growth Compound Account That Adds $3,000 in 60 Days or Less To Your Current Working Capital On Your Balance Sheet!

I understand I will get instant access to this 5-part Mini- Course,

no credit card required even if I don't pay the $24.95 upfront

Investing Money Versus Growing Money

Investing Money

Investing Money means Putting your funds into an asset, such as stocks, real estate, or bonds. Each asset has its own inherent growth rate, which determines the speed at which your money increases. This growth rate is largely beyond your control and is influenced by market conditions, the performance of the asset, and other external factors. Essentially, when you invest money, you are tying the growth of your money to the structure and performance of the asset you have chosen.

Growing Money

Growing money, on the other hand, is a dynamic process

that involves strategically moving your funds to maximize growth. This approach leverages the concept of Velocity of Money, where the speed at which money circulates and is utilized can be influenced by your actions. Unlike investing, growing money is not tied to any one asset but rather focuses on a continual process of reallocating funds to take advantage of opportunities, compounding benefits, and optimizing returns. By Actively managing the flow of your money, you have greater control over its growth rate.

The key takeaway is to focus on growing your money first through active management and strategic movement before committing it to specific investments. This approach allows you to accelerate your financial growth and optimize the returns from your investments

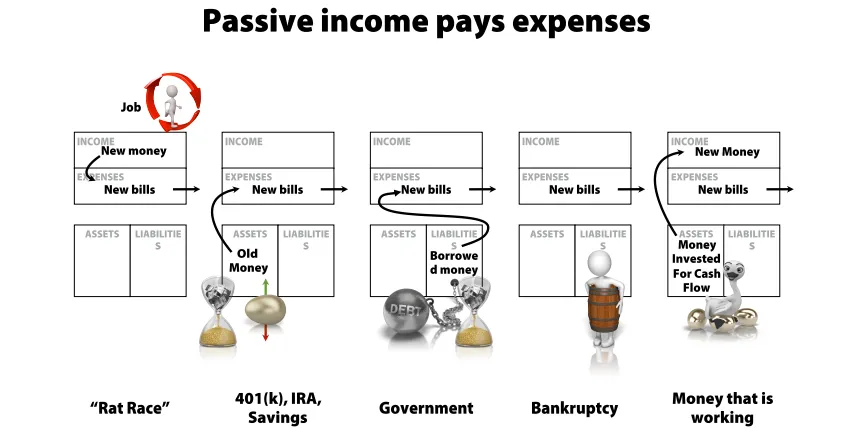

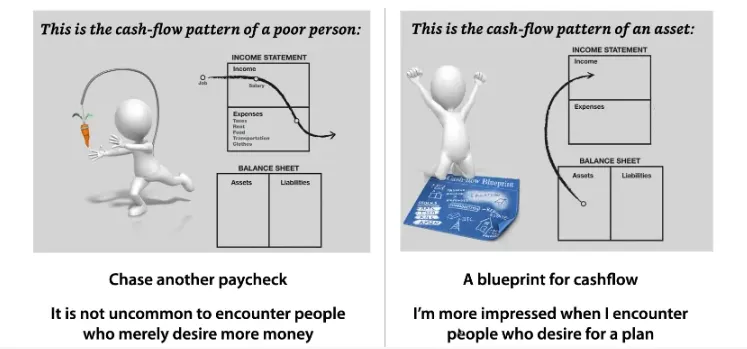

What Cash Flow Pattern Are You Currently Experiencing?

What is Included In The Equity Banking Management System!

W4 Tax Training Strategy to Put $200 - $600 back in Your Pocket in 72 Hrs Using the IRS Calculator!

Build A Great Credit Score to 750 with My Credit System Has all the Form Letters for Disputing If Something is Inaccurate on your Credit Report!

Cashflow Manager App & Tax Record Keeping System. Leveraging 162(a) of the IRS TAX code To Minimize Tax.

Debt Elimination Software, Adding a Product you can get at your Local Bank

Converts 72 months of Liability Payments Back Into Income in 10 Months Or Less!Cash-Flow Strategist Software to Manage Your Equity, Assets, & Portfolio with Strategic Investment Training That Creates your Own Financial Freedom Number for Financial Independence In 7 to 10 Years!

Developing Your Own Equity Compound Account That grows your Working Capital On your Balance Sheet every Month.

Investment Education Training So your assets Pays for Expenses and Active Income Buys more Assets Leveraging Time Value of Money.

Revenue Sharing with That adds additional Revenue Weekly.

$397 ONLY $24.95!

Its Not the Return ON your money that makes the difference; its the Return OF your money--shifting the money back to its original owner YOU...Begin Your Equity Banking Journey to New Found Money!

In Just 5 Days; "Master The New Rules of Banking Becoming Your Own Equity Asset Manager"!

Day 1 -Create Your Equity-Banking Blueprint: Safeguard Your Current Assets & Increase Your Income Simply by Knowing & Positioning Your Numbers Correctly.

Day 2-Customize Your Equity-Banking Blueprint:

Why Our Equity-Banking Blueprint Dominates The Traditional Financial Plan So your money starts working for you.

Day 3-Unlock Your Equity-Banking Scorecard: Plug Financial Leaks & Recover Cash! With Your Customized Plan You Will Capture Lost Money—Typically in Just 72 Hours to See Results!

Day 4-Engineer Your Equity-Banking Blueprint: Reduce the cost of money daily so your Income Producing Asset Pays your Current Expenses. This New Income Generating Asset Accelerates The Banking Process to See Results in 3 to 7 years Instead of the typical 30 years.

Day 5-Automate Your Equity-Banking Process:

Our Effortless 'Set-and-Forget' Strategy - Self Funds An Income Producing Asset So Your Wealth Ladder System Captures & Grows Your Income Every Year Automatically!

Additional Bonus Course Included:

After Your Initial 5 Days You will Have Access To Building The Perfect Equity Banking Management System That Compounds & Grows Your Working Capital Every Month without changing your Monthly Budget!

Bankers Bonus - Velocity of Money Strategy Session For Implementation: Advanced Strategy Session 1 on 1 with 30 Day Coaching to Build your Equity Banking Machine To Increase Financial Freedom to Only 7-10 Year!

I Have A Blueprint For Developing Your Own Equity Compound Account

Add $3,000 In Working Capital on Your Balance Sheet!

See what Our Case Studies are saying About Equity Banking!

Real Numbers. Real Savings.

With Your Course I can expect to pay off my home in 7.33 years saving a total of $86,457.09 with an effective interest rate of 1.312% & a Note Rate of 4.75% a on my existing mortgage. The projected growth of a future investment account that is funded using the discretionary income available once the mortgage balance is paid in full will be $461,562.23

Janet Kennerson

Real Numbers. Real Savings.

With Your program I can expect to pay off my home in 10.42 years and save a total of $166,468.49 with an effective interest rate of 3.529% & a Note Rate of 7.25% on my existing mortgage. The projected growth of a future investment account that is funded using the discretionary income that is available once the mortgage balance is paid in full will be a staggering $452,454.58

Greg Moreland